Block fees before they happen.

Hutsy monitors your accounts and warns you days before an overdraft, a missed payment, or a credit score drop.

16,000+ members protected$512+

saved per year on avg by catching overdrafts, late fees, and bad debt before they hit

Plans start at

$10

/month16K+

members protected

One alert.

Crisis avoided.

Americans lose $26 billion a year to preventable fees.

Your bank profits from the damage. Hutsy stops it before it hits.

Save

$512/yr

Featured In

Your bank charges $35 when you overdraft.

Hutsy warns you 3–7 days before it happens.

Hutsy monitors your accounts in real time and warns you days before an a payment is due — so nothing catches you off guard.

Overdraft detection

We flag when your balance is heading toward zero — before the fee hits.

Missed payment alerts

Get warned days before a bill is due so one forgotten payment doesn't tank your score.

Less debt. Better credit

We rank your debts by what's hurting your score most and tell you exactly where to start.

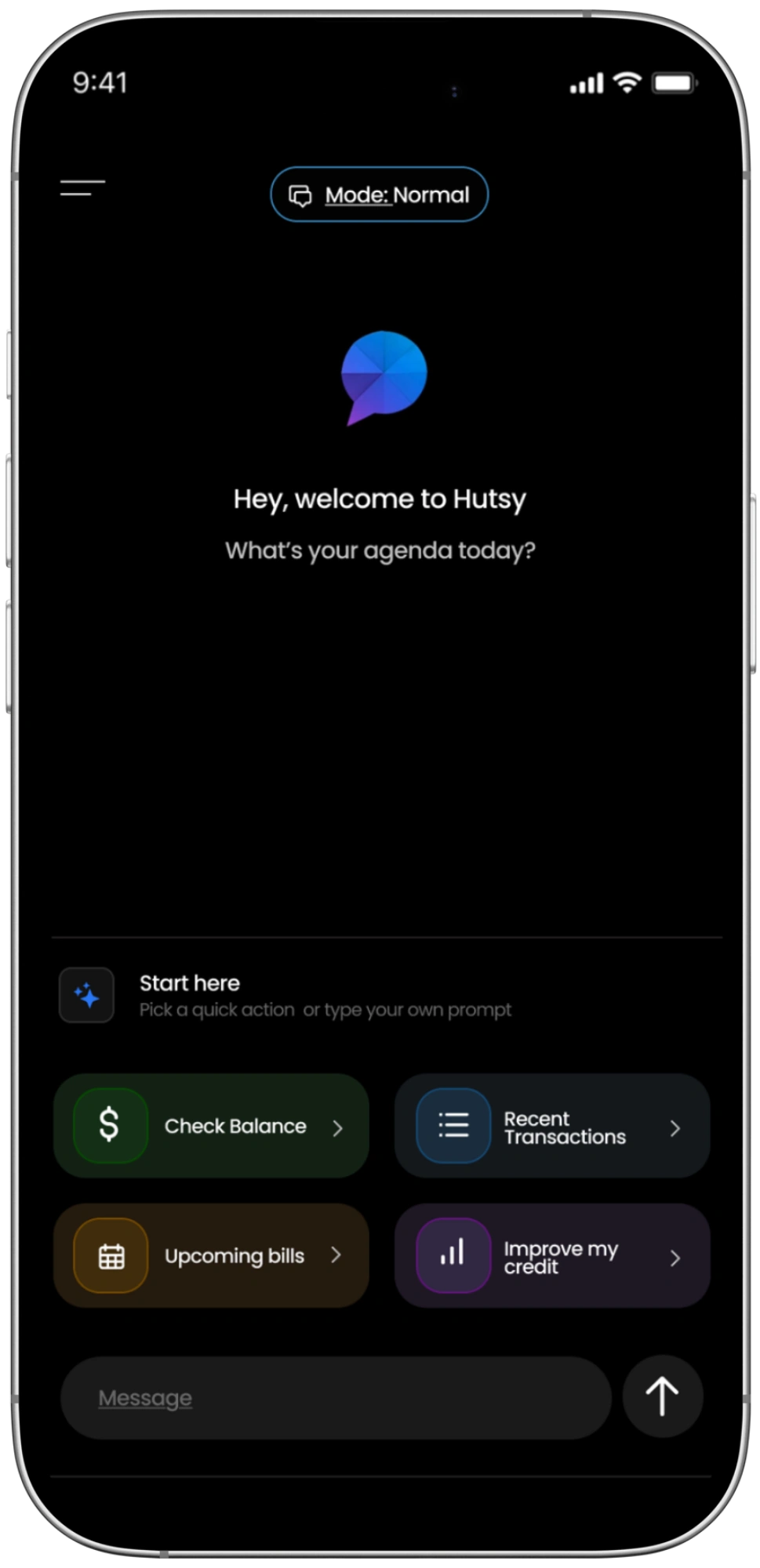

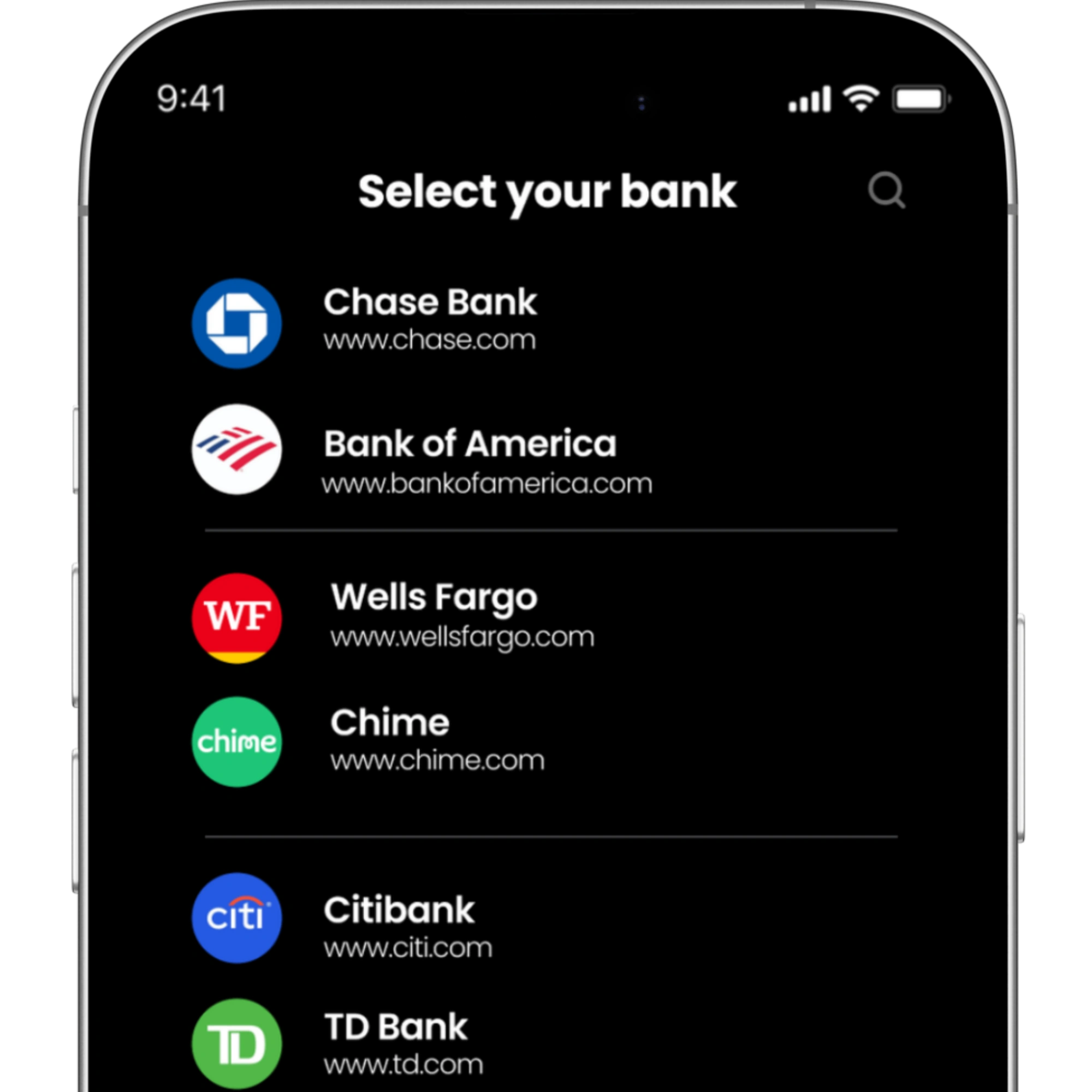

How it works

Connect your accounts.

Link your bank and credit accounts in under 60 seconds. Bank-level encryption via Plaid.

Hutsy starts watching.

We monitor your balance, bills, subscriptions, and credit in real time — and flag what's coming.

Wake up protected.

Every morning you get a briefing. Throughout the day, alerts if anything needs attention.

Everything your bank app should do, but doesn't.

Hutsy monitors your full financial picture — and actually tells you what's coming.

Overdraft Prevention

Your bank charges $35 when you overdraft. Hutsy warns you 3–7 days before it happens — with enough time to fix it.

Bill & Payment Alerts

Miss one payment and your score drops 60–100 points. Hutsy tracks every bill and warns you days before it's due — not after you've missed it.

Credit Score Monitoring

Full credit report from all 3 bureaus. See what changed, why it moved, and exactly which card to pay down first.

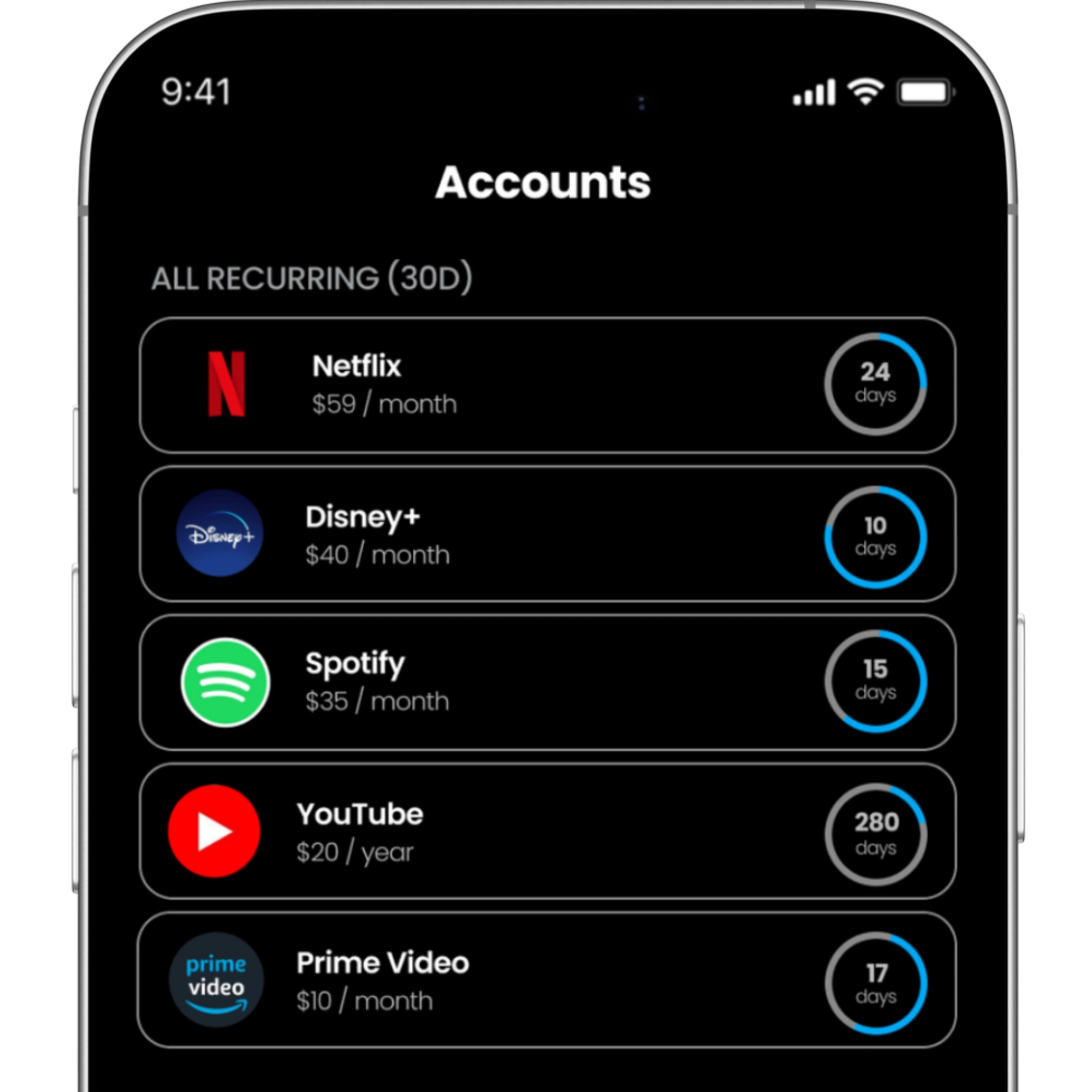

Subscription Tracker

The average member has $214/month in subscriptions. Hutsy finds the ones you forgot about so you can cut what you don't need.

AI Financial Assistant

Ask Hutsy anything about your money. It already knows your balance, your bills, and your goals — so the advice is yours, not generic.

Loan Marketplace

Compare offers from 50+ lenders in seconds. Personal loans up to $50,000 — matched to your credit profile, multiple offers. You pick the best rate.

The reviews speak for themselves

Hutsy warned me I was going to overdraft 3 days before it happened. I moved $60 from savings and avoided a $35 fee. Literally paid for itself in the first week.

— MarcusTThe morning briefing is the first thing I check every day. Balance, bills, what’s coming this week — all in 30 seconds. I haven’t been surprised by my bank in months.

— JessicaOnABudgetMy score went up 47 points in 4 months. Hutsy told me exactly which card to pay down first and how much. No other app has ever done that.

— DevinSavesHutsy found 3 subscriptions I forgot about — $34/month I was just throwing away. Cancelled all of them in the first week.

— SamInNYCI asked the AI how to split my paycheck and it already knew my rent, my bills, and my credit card balance. Felt like talking to a financial advisor who actually knows my situation.

— EmmaTOther apps just show your score. Hutsy actually explains what’s holding it back and tells you exactly how to fix it. My score is the highest it’s ever been.

— JakeSavesI had a $189 car insurance payment I completely forgot about. Hutsy flagged it 4 days early. Without that alert I would've overdrafted.

— TrevorKI used to check my bank account 5 times a day out of anxiety. Now I just check my Hutsy briefing at 7:30 and I'm good.

— AshleyMoneyTwo months in and I haven't paid a single overdraft fee. Before Hutsy I was averaging two a month. That's $70/month I'm keeping.

— DanielRHutsy warned me I was going to overdraft 3 days before it happened. I moved $60 from savings and avoided a $35 fee. Literally paid for itself in the first week.

— MarcusTThe morning briefing is the first thing I check every day. Balance, bills, what’s coming this week — all in 30 seconds. I haven’t been surprised by my bank in months.

— JessicaOnABudgetMy score went up 47 points in 4 months. Hutsy told me exactly which card to pay down first and how much. No other app has ever done that.

— DevinSavesHutsy found 3 subscriptions I forgot about — $34/month I was just throwing away. Cancelled all of them in the first week.

— SamInNYCI asked the AI how to split my paycheck and it already knew my rent, my bills, and my credit card balance. Felt like talking to a financial advisor who actually knows my situation.

— EmmaTOther apps just show your score. Hutsy actually explains what’s holding it back and tells you exactly how to fix it. My score is the highest it’s ever been.

— JakeSavesI had a $189 car insurance payment I completely forgot about. Hutsy flagged it 4 days early. Without that alert I would've overdrafted.

— TrevorKI used to check my bank account 5 times a day out of anxiety. Now I just check my Hutsy briefing at 7:30 and I'm good.

— AshleyMoneyTwo months in and I haven't paid a single overdraft fee. Before Hutsy I was averaging two a month. That's $70/month I'm keeping.

— DanielRHutsy caught a subscription price increase I never would've noticed. Paramount+ went from $5.99 to $11.99 and I was still paying it.

— NicoleSavesI asked Hutsy if I could afford to buy new tires this week. It looked at my balance, my bills coming up, and told me to wait until after Friday when my paycheck hits. That's real advice.

— ChrisOnABudgetMy credit went from 612 to 674 in 5 months. Hutsy told me my utilization was at 68% and showed me exactly how to get it under 30%. It worked.

— BriannaWThe Friday recap is underrated. Seeing what I spent, what I saved, and what's coming next week — it's like a weekly financial reset.

— MikeDI was paying $47/month in subscriptions I didn't use. Hutsy found all of them in the first 24 hours. $564 a year I was just giving away.

— RachelKMy rent autopay almost hit when I only had $1,100 in checking. Rent is $1,250. Hutsy warned me Tuesday and I transferred money that night.

— JordanTI've tried Mint, YNAB, and Credit Karma. None of them told me what was about to happen. They only showed me what already did. Hutsy is the first app that actually warns me.

— KaylaSavesHutsy told me a hard inquiry hit my credit report that I didn't recognize. Turned out someone applied for a store card in my name. Caught it the same day.

— AnthonyM$10/month to never worry about my bank account again. I don't know why every bank doesn't do this. Oh wait — they make money when I mess up.

— TinaBHutsy caught a subscription price increase I never would've noticed. Paramount+ went from $5.99 to $11.99 and I was still paying it.

— NicoleSavesI asked Hutsy if I could afford to buy new tires this week. It looked at my balance, my bills coming up, and told me to wait until after Friday when my paycheck hits. That's real advice.

— ChrisOnABudgetMy credit went from 612 to 674 in 5 months. Hutsy told me my utilization was at 68% and showed me exactly how to get it under 30%. It worked.

— BriannaWThe Friday recap is underrated. Seeing what I spent, what I saved, and what's coming next week — it's like a weekly financial reset.

— MikeDI was paying $47/month in subscriptions I didn't use. Hutsy found all of them in the first 24 hours. $564 a year I was just giving away.

— RachelKMy rent autopay almost hit when I only had $1,100 in checking. Rent is $1,250. Hutsy warned me Tuesday and I transferred money that night.

— JordanTI've tried Mint, YNAB, and Credit Karma. None of them told me what was about to happen. They only showed me what already did. Hutsy is the first app that actually warns me.

— KaylaSavesHutsy told me a hard inquiry hit my credit report that I didn't recognize. Turned out someone applied for a store card in my name. Caught it the same day.

— AnthonyM$10/month to never worry about my bank account again. I don't know why every bank doesn't do this. Oh wait — they make money when I mess up.

— TinaBHave a question?

What is Hutsy?

How does Hutsy warn me about overdrafts?

What is the morning briefing?

How does credit monitoring work?

Is my data safe?

Does Hutsy issue loans?

How is Hutsy different from my banking app?

Can I cancel anytime?

How much does Hutsy cost?

How fast does Hutsy start working?

Your bank profits when you overdraft.

Hutsy makes sure you never do.

16,000+ members protected.