Short

on

Cash?

We’re

here

to help.

Borrow up to $15,000 — apply once we send it to 50+ lenders and you pick the offer you want.

How Hutsy works

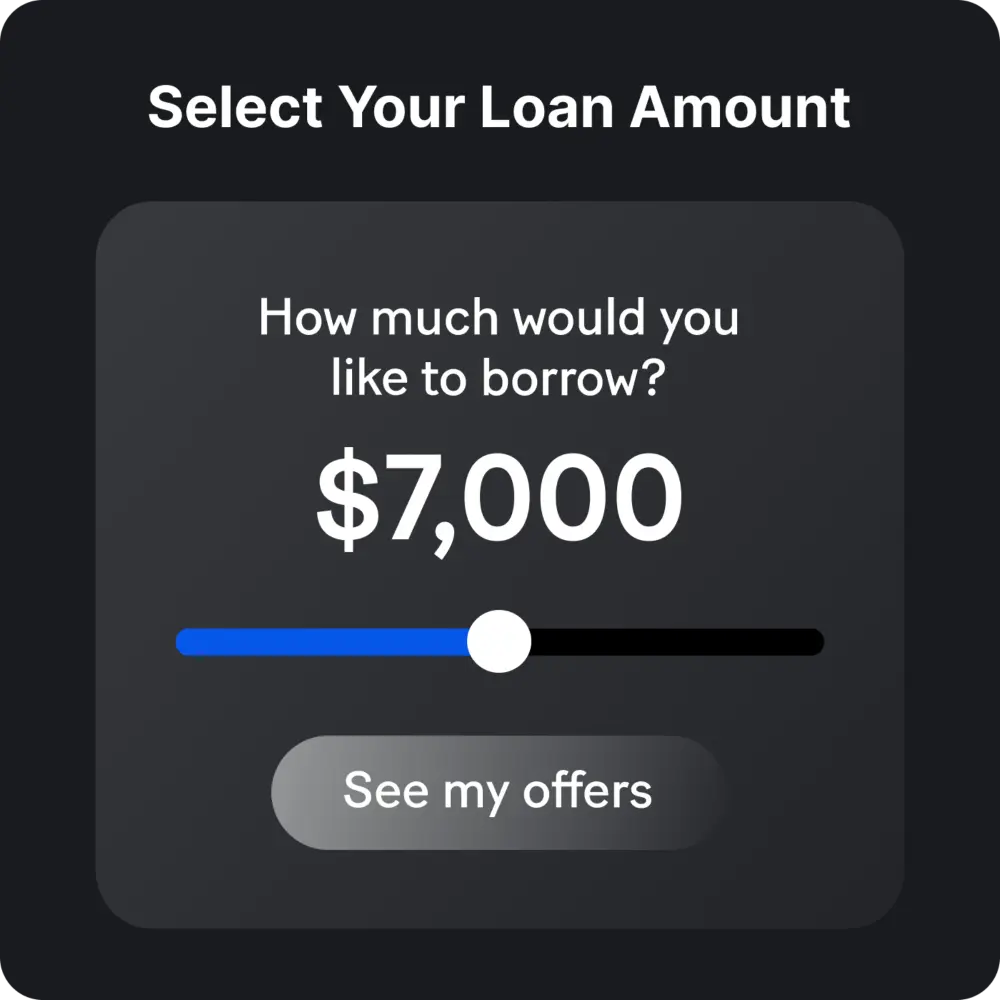

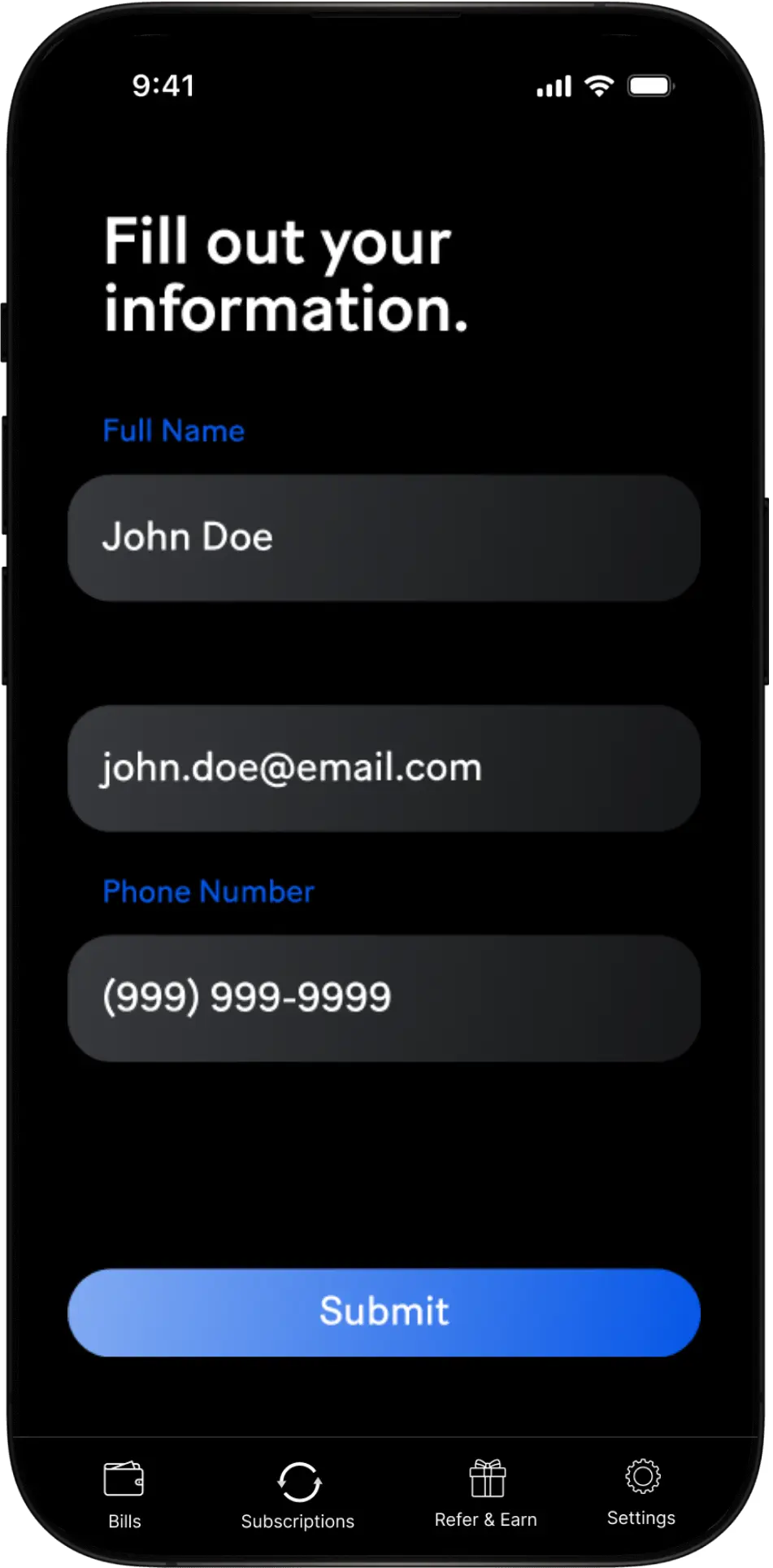

Choose how much you’d like to borrow — from $100 up to $15,000.

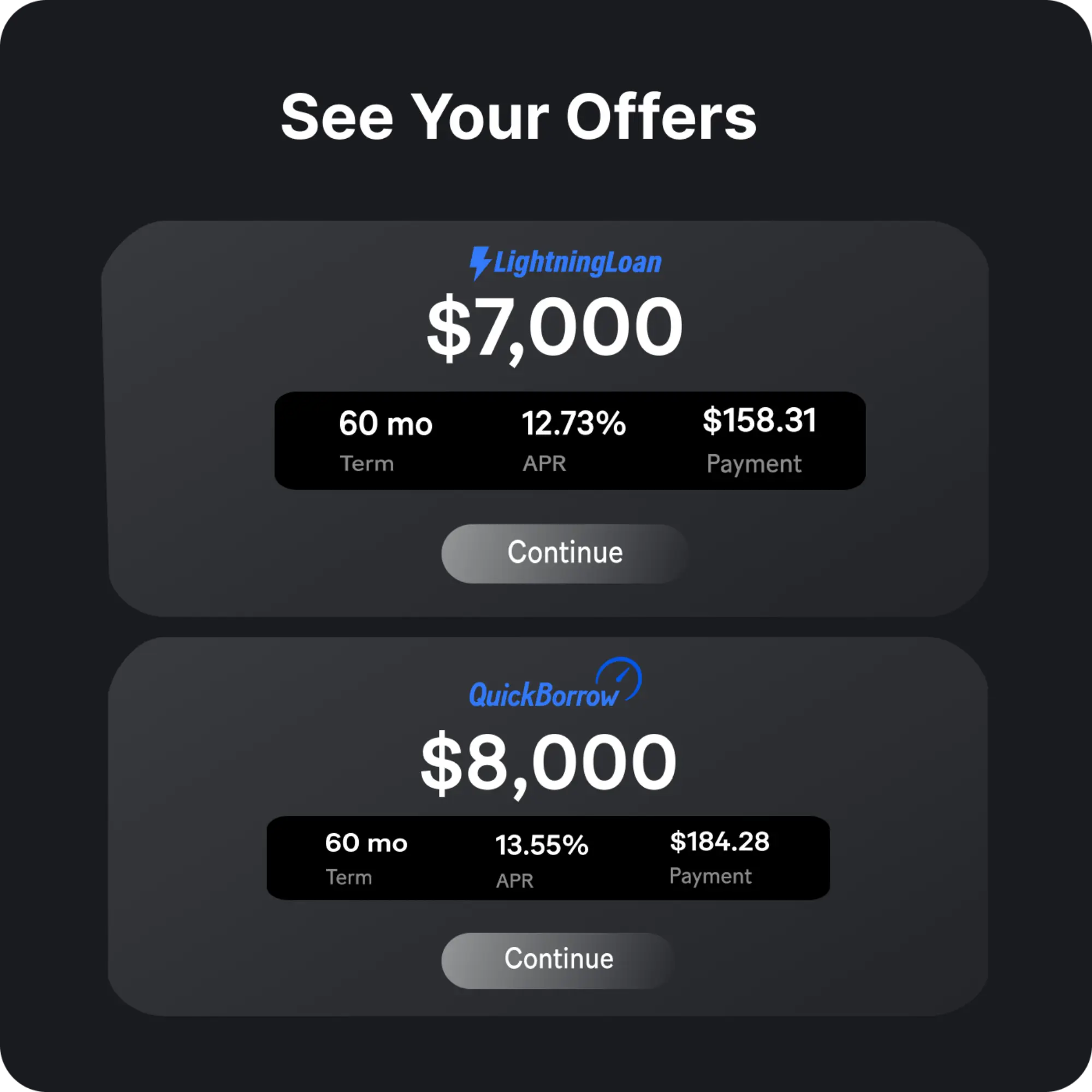

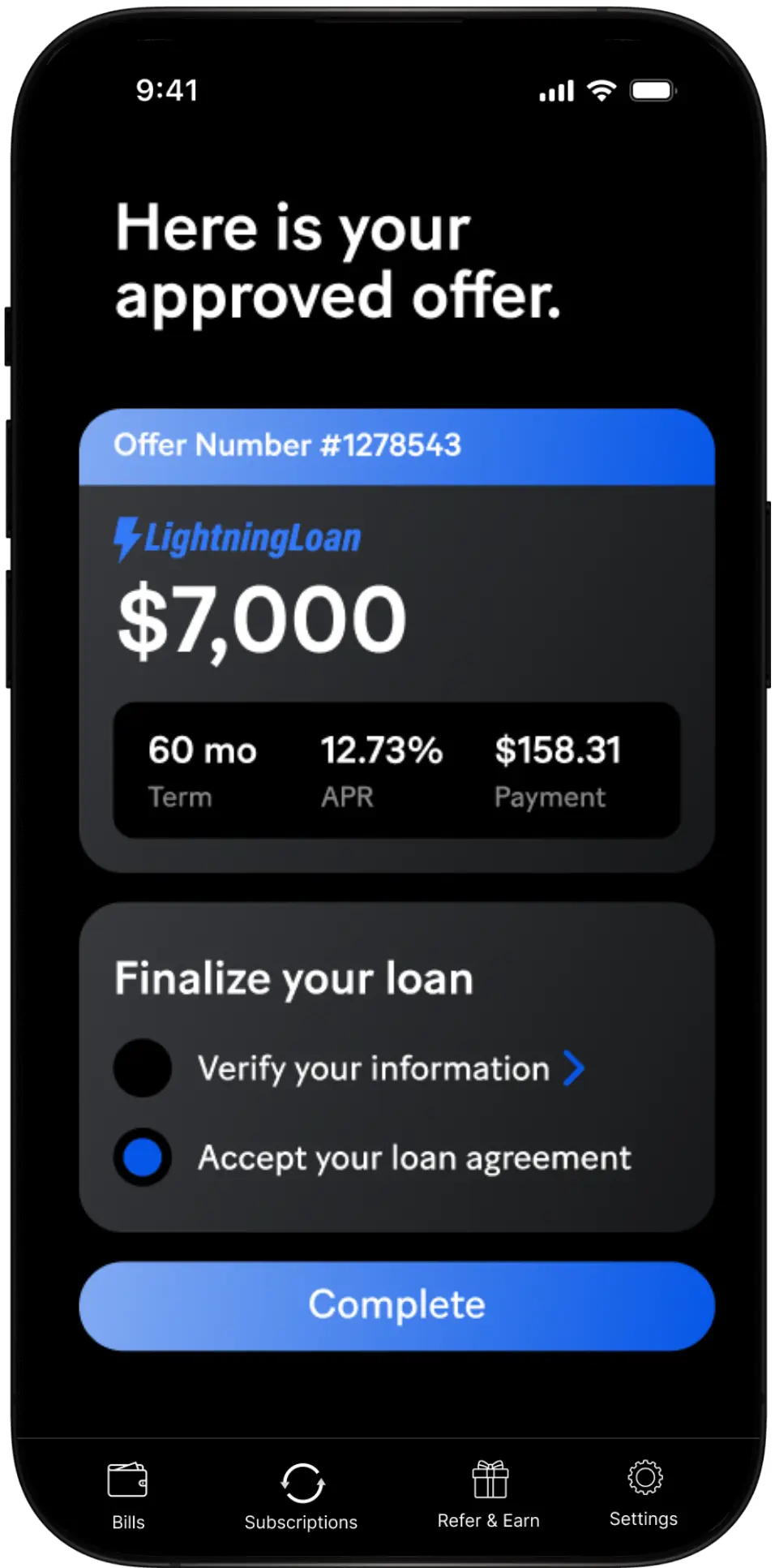

See your approved offers from up to 50+ lenders.

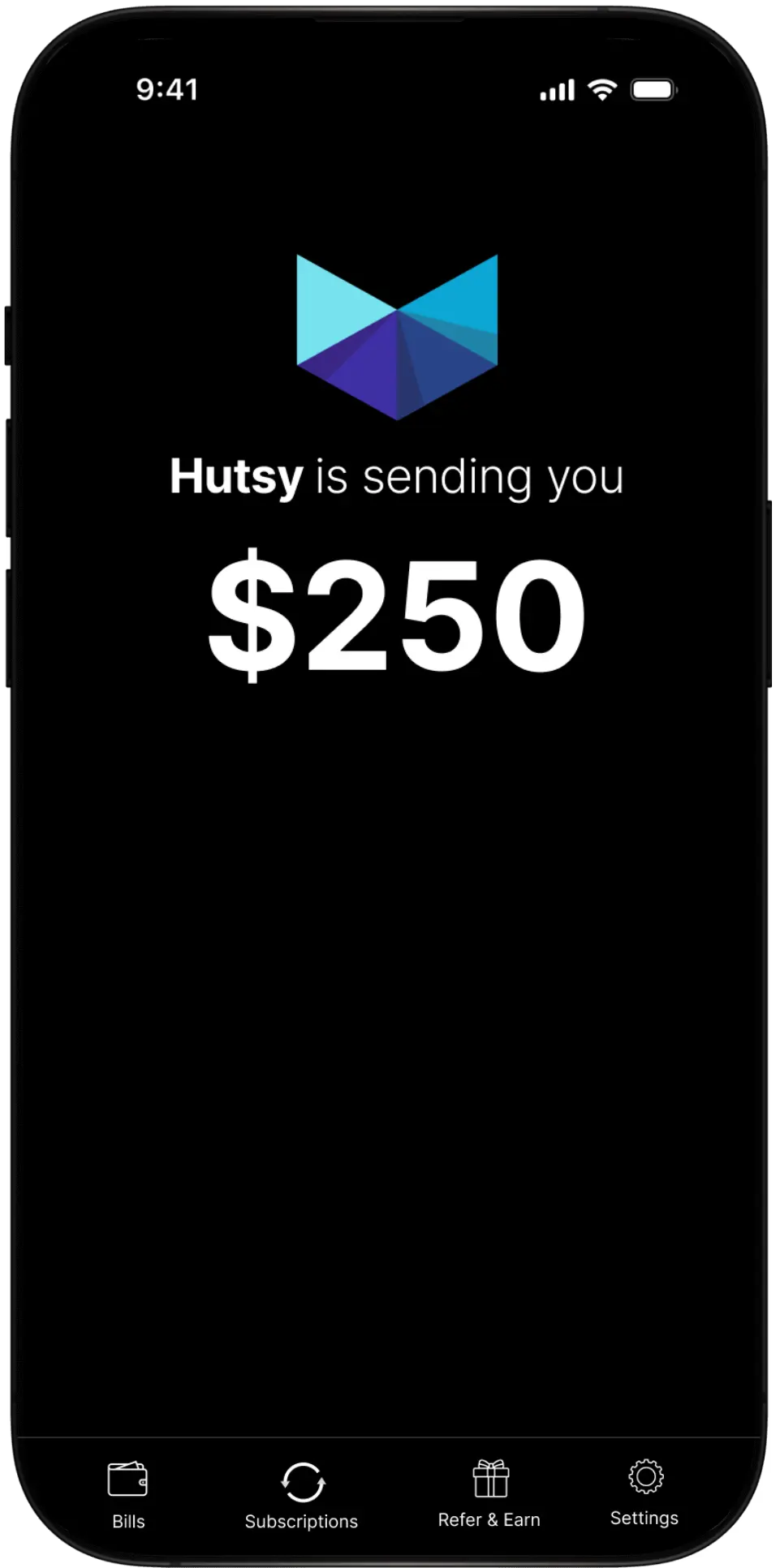

Receive money fast, directly and securely.

Choose how much you’d like to borrow — from $100 up to $15,000.

See your approved offers from up to 50+ lenders.

Receive money fast, directly and securely.

Stay Ahead, Secure & In Control

Ahead

Apply once and get sent to 50+ trusted lenders, so you always know your best offers are just a tap away.

Secure

Connect your bank with bank-level encryption — funds go directly into your account, safely and instantly.

Control

See all your loan offers in one place and stay in control by choosing the option that works best for you.

One Application → 50+ Lenders

Get access to offers even if you don’t have established credit

The reviews speak for themselves

4.8

Star review from real Hutsy members

I applied in minutes and was instantly matched with a $5,000 loan offer. The process was way easier than going bank to bank!

— JakeOnABudget 🇺🇸I didn’t think I’d qualify, but Hutsy connected me with multiple lenders. I picked the best rate and had funds in my account the next day.

— SarahLovesSavings 🇺🇸Super simple — I selected my loan amount, saw offers right away, and chose the one that fit my budget.

— JasonH22 🇺🇸I love that I could compare offers from different lenders all in one place. It saved me so much time.

— EmmaT 🇺🇸The approval came back in seconds. I didn’t have to fill out a dozen applications — just one.

— Nathan_D 🇺🇸Funds hit my account within hours after I accepted the offer. Exactly when I needed it most.

— BudgetQueen 🇺🇸I felt in control the whole way — I chose the lender, the terms, and where the money was sent.

— SamInNYC 🇺🇸The app is straightforward and transparent. No hidden fees, just clear loan offers.

— JakeSaves 🇺🇸I was able to go from application to approval in less than 10 minutes. Honestly the smoothest loan experience I’ve had.

— TVAddict92 🇺🇸I was stressed about covering bills, but Hutsy helped me secure a $2,500 loan in less than a day.

— FinanciallyFree22 🇺🇸"The process was fast and painless — just a few taps and I had multiple offers to choose from."

— DebtFreeSoon 🇺🇸I finally felt like I had options instead of getting declined everywhere else.

— TomTheSaver 🇺🇸Hutsy made borrowing simple. I picked the amount I needed and saw lenders willing to work with me.

— SavvySpender 🇺🇸The funds went straight into my bank account, and I could track everything in the app.

— ChloeOnABudget 🇺🇸I liked that Hutsy checked back each week until I was approved. It showed they were looking out for me.

— NoMoreWastedCash 🇺🇸Getting matched with lenders through Hutsy saved me from applying on a dozen different websites.

— JakeK 🇺🇸I used Hutsy when my car broke down, and the loan came through faster than I expected.

— AlexF 🇺🇸Seeing multiple offers side by side gave me confidence I was getting the best deal.

— BudgetBenny 🇺🇸

Built for privacy. Your finances, fully private and secure.

Hutsy is built with your privacy in mind. Your financial data stays protected with industry-standard encryption and is never sold, tracked, or shared without your consent. No ads, no gimmicks—just tools to help you save money and stay in control.

Hutsy is in the process of becoming a B Corporation meaning we’ll legally be committed to putting your privacy and well-being first.

Watch Lip explain how Hutsy spots you when needed to pay your bills below 👇

Have a question?

How does Hutsy work?

Hutsy connects you to a network of over 50 trusted lenders. You select how much you’d like to borrow, review your personalized offers, and choose the loan that works best for you. Funds are then deposited directly into your bank account.

What types of loans can I apply for?

You can apply for personal loans, debt consolidation loans, and small-dollar cash advances. Loan amounts range from as little as $50 to as much as $15,000 depending on your approval.

How fast can I get approved?

Most approvals happen within seconds after submitting your application. If no offers are available right away, Hutsy will automatically re-check each week and notify you when a new offer is available.

Is Hutsy safe to use?

Yes. Hutsy uses bank-level encryption to connect your account securely, and your data is only used to match you with loan offers.

Can I choose which bank account my loan goes into?

What happens if I’m not approved for a loan?

If no offers are available right now, Hutsy will continue to check with our lending partners on your behalf. Most members receive an approval within a few weeks.

Who we are and why we care

At Hutsy, we believe everyone deserves access to fair credit without the stress of endless applications or hidden fees. We exist to help you move forward—connecting you instantly to 50+ trusted lenders, showing you clear loan options, and giving you the power to choose what’s right for you.

Your bank account should reflect opportunity, not obstacles.

That’s why we built Hutsy—to open the door to affordable credit, simplify financial decisions, and put you back in control of your future.

© 2025 Hutsy. All Rights Reserved.

Terms & Privacy